How Piraeus Bank Cut Loan Processing Time by 86%

Greece's leading bank reduced 20,000 monthly loan applications from 35 to 5 minutes with QPR ProcessAnalyzer

Piraeus Bank processed 20,000 loan applications monthly but couldn't see where delays were happening in their consumer loan process. They used QPR ProcessAnalyzer to identify exact bottlenecks in just 5 minutes and cut loan processing lead times by 86%, dramatically improving customer experience.

The Challenge:

Processing 20,000 loan applications monthly across a complex consumer loan process with over 1 million events, but no visibility into where delays were occurring or why some applications took much longer than others.

The Solution:

QPR ProcessAnalyzer analyzed all transaction data from their systems and provided instant visibility into process bottlenecks, inefficiencies, and root causes of delays.

The Results:

Reduction in consumer loan process lead time

Time to identify bottlenecks after connecting data

Events analyzed in the consumer loan process

"We gave the data to QPR ProcessAnalyzer, and right away, in 5 minutes, we saw the bottlenecks of the process."

Lambros Bessas

Senior Manager at Piraeus Bank

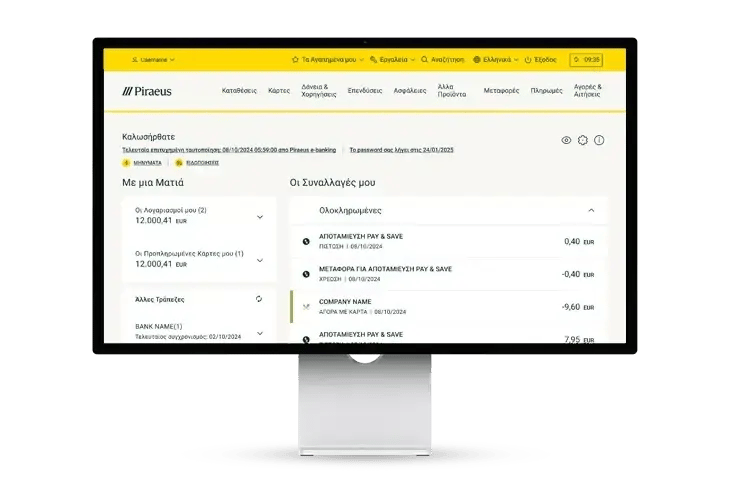

About Piraeus Bank

Piraeus Bank was founded in 1916 and today represents the leading bank in Greece in terms of customer loans and deposits. With €34.7 billion in net loans, €55.8 billion in deposits, 8,800 employees, and 5.7 million customers, Piraeus Bank is a major financial institution serving the Greek market.

The challenge

Processing 20,000 loan applications through a complex, non-standardized process

The data was there, but no one could see the story it told

Piraeus Bank faced the classic challenge of scale without insight. Every month, they processed 20,000 consumer loan applications through a complex process generating over 110,000 user events.

The bank knew loan processing was taking too long and customers were frustrated, but they couldn't identify where the bottlenecks were occurring or why some applications moved quickly while others got stuck for weeks.

Traditional analysis methods had failed

Previous attempts to understand their loan process relied on traditional process mapping, interviews, and workshops. These methods were time-consuming and provided only subjective snapshots of how the process was supposed to work - not how it actually performed in reality.

The traditional approaches couldn't handle the volume and complexity of their operation. With over 1 million events occurring in their consumer loan process, manual analysis was impossible, and automation initiatives weren't delivering the expected results.

No way to prioritize improvements

Without visibility into actual process performance, Piraeus Bank couldn't prioritize their improvement efforts. They were making assumptions about what needed to be fixed rather than knowing exactly where the problems were occurring and why.

Management needed concrete evidence to make informed decisions about process improvements and resource allocation, but the data remained locked in their systems without any way to extract meaningful insights.

The solution

Instant process visibility with QPR ProcessAnalyzer

Analyzing over 1 million events instantly

QPR ProcessAnalyzer was selected specifically because it was the only process mining tool capable of handling Piraeus Bank's massive data volume. With over 1 million events in their consumer loan process, they needed a solution that could process large amounts of data instantly and deliver immediate results.

QPR's dynamic and automatic process visualization capabilities, combined with market-leading root cause analysis and comprehensive KPI monitoring, made it the clear choice for Piraeus Bank's complex operational requirements.

5 minutes to see what had been hidden for years

The transformation began the moment Piraeus Bank provided their data to QPR ProcessAnalyzer. Within just 5 minutes, the bottlenecks that had been hidden in their complex workflow became clearly visible.

This instant visibility replaced weeks or months of traditional analysis with immediate, actionable insights. The tool revealed specific bottlenecks, inefficient process variants, and their underlying causes - giving the team concrete areas to focus their improvement efforts.

Root cause analysis and bottleneck identification

QPR ProcessAnalyzer's root cause analysis capabilities enabled Piraeus Bank to move beyond just identifying problems to understanding why they were happening. The tool revealed specific bottlenecks, inefficient process variants, and their underlying causes.

This insight was crucial for developing targeted solutions rather than implementing broad changes that might not address the actual root causes of delays and inefficiencies.

The results

From guesswork to instant visibility

Unprecedented process transparency

For the first time, Piraeus Bank could see their complete consumer loan process in action. They gained visibility into all process variants, understood why certain applications took longer than others, and identified specific steps that consistently caused delays.

The comprehensive view enabled them to understand not just what was happening, but why it was happening and how different factors contributed to overall process performance.

Loan applications now take 5 minutes instead of 35 minutes

Based on the insights provided by QPR ProcessAnalyzer, Piraeus Bank achieved dramatic time savings: loan applications that previously took 35 minutes on average now take just 5 minutes. This represents an 86% reduction in process lead times that transformed the customer experience.

The bank could now process loan applications much more quickly while maintaining quality and compliance standards, leading to higher customer satisfaction and improved competitive positioning.

Data-driven process improvements

The fact-based findings from process mining enabled Piraeus Bank to make targeted improvements rather than broad, unfocused changes. They could demonstrate the impact of bottlenecks to management and provide specific recommendations for optimization.

This data-driven approach ensured that improvement efforts were focused on areas that would deliver the maximum impact on customer experience and operational performance.

Lambros Bessas shares the transformation story

Watch Lambros Bessas, Senior Manager at Piraeus Bank, explain how customer complaints led to a process mining breakthrough. (43 seconds)

Get started in minutes

Start using QPR ProcessAnalyzer on Snowflake Marketplace within 3 minutes.

Got some questions or want to see QPR in action? Book a slot with our specialist who can answer all your questions